It's Time to Get Credit Savvy!

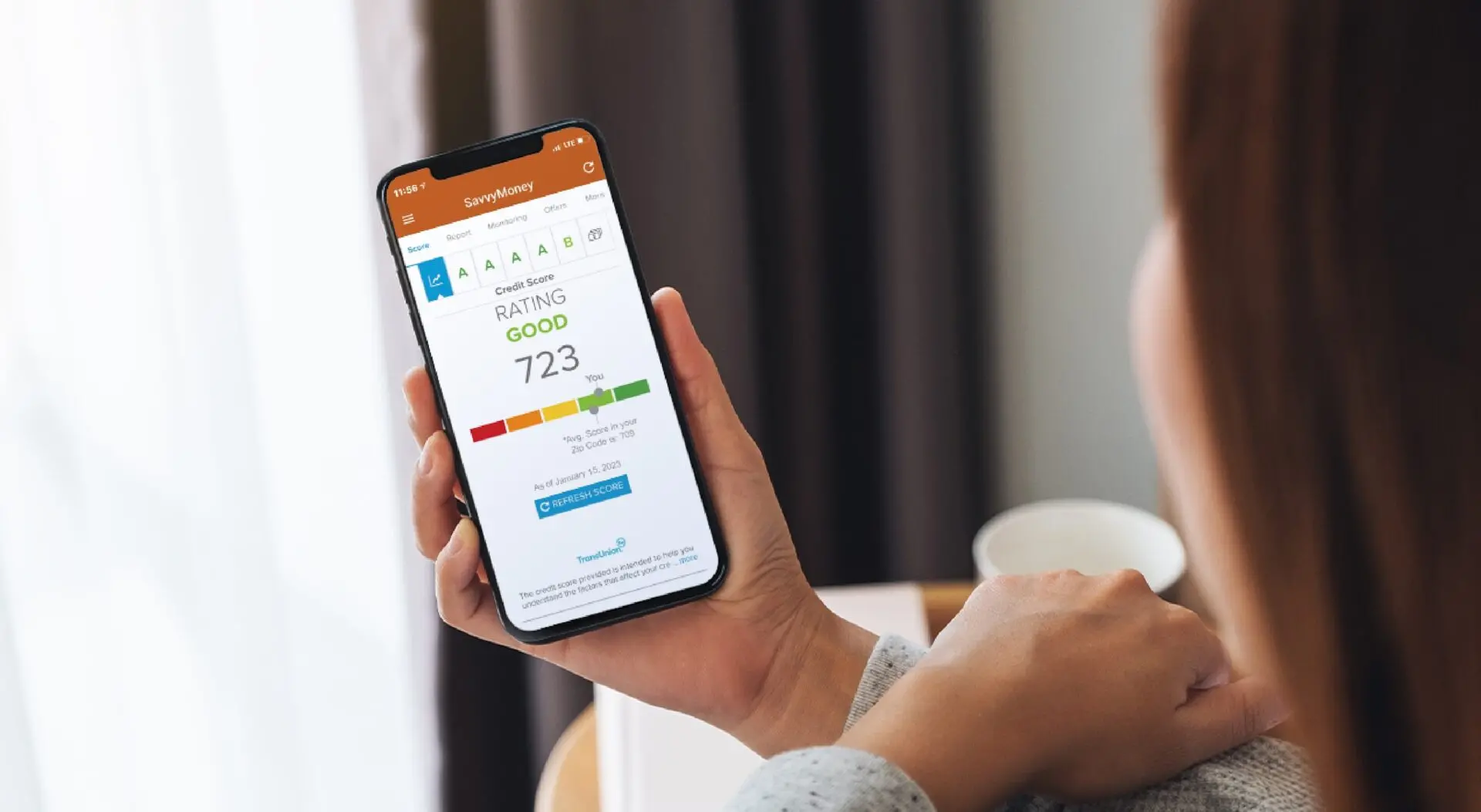

Empower your financial decisions with our FREE SavvyMoney® tool.

We’re ready to put your mind at ease by providing real-time access to your credit health. SavvyMoney® is a simple solution that helps build credit confidence while still keeping your credit score front and center.

This tool has been seamlessly integrated into our online and mobile banking for your convenience, where you can access it anytime, anywhere!